As a business owner, you may dream of taking your business to the next level of growth and profitability but lack the necessary capital to make this happen. Alternatively, you may be looking to move on to another project or leave the demanding world of entrepreneurship altogether but want to ensure that your business is sold for an amount you believe it is worth. Unfortunately, you may find yourself unequipped to attract the desired capital or investors you so urgently need. If this is your situation, you may be in the market for professional services that can help you make this dream a reality.

A Chartered Business Valuator can help.

In this article, we’ll describe the role Chartered Business Valuators (CBVs) play in helping businesses attract investment through business valuation; define business valuation and explain how it can benefit entrepreneurs; discuss the reasons small businesses fail to access capital from banks; and explain how you can improve your chances of attracting investors.

How Chartered Business Valuators can help you get the capital your business needs

According to the Chartered Business Valuators Institute, “Chartered Business Valuators (CBVs) are accredited finance professionals with extensive knowledge and expertise in the specialized field of business valuation.”

CBVs are internationally recognized and well-respected business professionals who typically assist with lawsuits, estate, and succession planning, deal advisory, calculating goodwill, developing financial models, conducting risk assessments, and value creation services.

In case you’re unfamiliar, getting your business valuated is an essential step in determining the kind of capital injection your firm is likely to receive or the value your company can be sold for.

Given the importance of this activity, it’s critical that you enlist the right people to get it done correctly.

The Harvard Business School defines business valuation, as “the process of assessing the total economic value of a business and its assets”. This process is undertaken to determine the current value of the company and considers all aspects of the business such as cash flow, expenses, economic and political context and intangibles such as intellectual property and the brand.

CBVs can aid in crafting a defensible business valuation.

But how exactly does this benefit entrepreneurs?

There are several benefits of business valuations for entrepreneurs as the Corporate Finance Institute explains. These include:

- Preparing your business for sale or to buy a business;

- Assessing the likelihood of future profitability and value creation when taking on new projects;

- Enhancing credibility to secure capital financing from banks and potential investors and;

- Determining the intrinsic value of securities to decide whether to invest.

Unfortunately, many small and medium-sized businesses have been unable to tap into these benefits and consequently lost out on opportunities to impress capital providers in the market.

Why do small businesses fail to access capital from banks?

Moody’s Analytics shared that following the 2008 global economic downturn, banks adopted stricter credit policies in response to increased regulatory oversight designed to prevent a recurrence of that worldwide crisis. These measures impacted their costs and profitability and resulted in tightened funding access to even the most financially stable small and medium-sized companies.

This notion was supported in the Central Bank of Trinidad and Tobago’s working paper entitled “Implications of New Financial Regulations on Small Business Financing in Trinidad and Tobago”. The report suggested that “heightened regulatory control and adverse economic conditions can exacerbate credit rationing for small businesses, especially in young firms with opaque business models”.

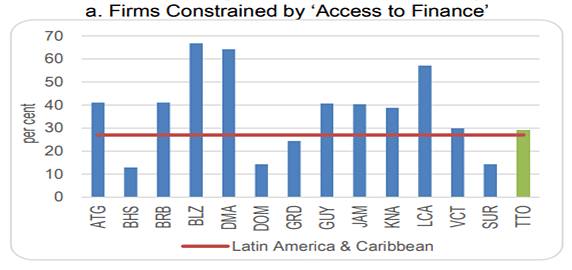

Taken from Central Bank Report “Implications of New Financial Regulations on Small Business Financing in Trinidad and Tobago.”

The report also identified that firms across Latin America and the Caribbean have experienced varied levels of constrained access to finance. More than 50% of SMEs in Belize, Dominica and St. Lucia reported difficulties accessing business finance. Additionally, 40% of firms in Jamaica and just under 30% of businesses in Trinidad and Tobago had trouble getting the capital needed to invest in their businesses.

Exacerbating this issue is the general reluctance of small businesses to gain capital access through stock exchange listings. This is likely due to the heavy reliance on commercial bank loans as well as the tedious requirements for stock exchange ratings and listings.

In addition, SMEs are generally viewed as less attractive due to the high levels of uncertainty and risk they are perceived to have.

ACCA Global identified a few reasons for this:

- They lack experience in raising investments and producing suitable returns;

- They lack sufficient internal controls;

- Decision making of sole owners lacks scrutiny and;

- They lack the requisite tangible assets that can be used as security.

How to improve your chances of accessing capital from banks

Establish Proof of Concept

In a recent interview on 106.5 FM, Chartered Business Valuator, Kevin Valley, advised small, micro, and medium businesses who are unable to receive support from the banks that they should seek to establish proof of concept.

He advised that if you can’t get funding for your ideas, there is a middle ground where you can test it via a survey or rough version of the product i.e. a minimum viable product. His company, KevinValue Consulting, provides this service and has created scorecards to assess whether people are interested in prospective products.

Kevin shared that banks want to see that prospective clients have de-risked the project for the investor. All businesses pitch growth; no one approaches investors for money saying that their business model will fail. You can differentiate yourself by testing the concept and sharing the expected demand level with potential investors.

Write a Business Plan

In addition to establishing proof of concept, there are some other key elements needed to make your business more attractive to investors. In a previous article, we discussed the basic steps to becoming an investible business which can potentially increase the value of your company. However, another critical step in securing an investment is crafting a business plan.

Earlier I mentioned that young firms with opaque business models typically encounter problems accessing capital from banks. A well-crafted business plan can provide clarity on how your business creates, delivers, and captures value within its specific economic and social context.

Not to be confused with a business model canvas (a one-pager listing different aspects of the business you are trying to build or run), a business plan articulates the problem to be solved or the solution provided. It also answers key questions you are likely to encounter in a pitch meeting with investors.

Your business plan should answer questions such as:

- Who is the target market?

- Who can you create the most value for?

- Who do you like working with and have easy access to?

- Who is willing to pay a premium for your product or service?

- How do you plan to acquire those customers i.e. your go-to-market strategy?

- What does your competitive environment and industry look like?

In addition to serving as a tool to pitch to potential investors, the Corporate Finance Institute, advised that business plans are useful as a focusing device for the conducting of your business, provide foresight on future challenges and outline the feasibility of one’s idea in the context of the current market.

Calculate Financial Projections & Create a Pitch Deck

After you’ve created a business plan, financial projections should be next on your agenda. Your goal here is to create a credible picture of what you expect your cash flow and expenses to look like.

Following this, you can create a pitch deck to incite interest from investors during pitch meetings. The pitch deck is a 15-20 slide document that outlines the salient points of your business plan and financial projections. It’s not typically meant to be a thesis document unless it’s being sent to prospective investors as a standalone document for them to conduct their own due diligence.

Implementing the above elements can significantly improve your chances of winning capital investments.

How to Get Started

If you’re ready to take that next step to raise capital from an investor or you want your business to be acquired but want to ensure that you receive a fair amount for what you’ve built or the idea you’ve developed, you should consider contacting a CBV.

They can set up an initial business meeting to see where you are and what you want to accomplish.

Consultants like Kevin Valley of KevinValue Consulting, with a 15-year+ track record of working in banking, finance and investments, typically conduct due diligence on what investors usually ask for before evaluating a deal for investment. Kevin’s checklist consists of corporate, financial, operational, and legal due diligence.

A 2nd meeting will follow if both parties decide they want to work together based on the cost.

With your business valuation in the hand of a Chartered Business Valuator, you can rest assured that your true business worth will be uncovered and that you can access the type of capital you need to take your company to the next level.

Ready to scale your business but need help getting to the next step? Contact KevinValue Consulting for assistance.